Please update your browser.

2017 Soft Commodities Compact Report

Introduction

J.P. Morgan is an adopting bank of the Soft Commodities Compact1 (‘the Compact’), a voluntary initiative led by The Consumer Goods Forum and The Banking Environment Initiative.2 The Compact promotes sustainable soft commodity supply chains in the banking industry by committing banks to helping achieve zero net deforestation by 2020 in their financing of sectors such as palm oil, timber products and soy. This report describes J.P. Morgan’s approach to implementing the Compact commitments and provides an overview of our progress.

Our Approach

Nature of exposure to relevant soft commodities

J.P. Morgan currently has active client3 relationships in the palm oil, timber products and soy sectors.

Banking services provided to clients in these sectors include, but are not limited to, traditional credit products, capital markets services (e.g. debt and equity underwriting), derivatives products and financial advisory roles.

Definition of ‘customers’

We define ‘customers’ as clients of J.P. Morgan’s Corporate and Investment Bank (CIB) that we have an active banking relationship with and/or that have gone through the Firm’s client onboarding process.

Transactions in sectors requiring enhanced due diligence as outlined in the Firm’s Environmental and Social Policy Framework4 (the ‘Framework’), which include the commodities referenced by the Compact, are automatically identified via a dedicated data system for review by the J.P. Morgan Global Environmental & Social Risk Management team.

Assessment of ‘significance’ of soft commodity-related elements to client businesses

In the event of a transaction where relevant soft commodities constitute only a part of a client’s business, a case-by-case assessment will be made on the materiality of the relevant business segment to the client’s overall revenues. Objective data points (e.g., percent contribution of the soft commodity segment to overall revenues) are a helpful guide in determining materiality, but the Firm does not set formal de minimis thresholds, as our experience suggests consideration of contextual factors (e.g., sensitivity of operating location) is important when making a determination.

Minimum requirements for customers

J.P. Morgan’s Framework reflects the broad intent of the Soft Commodities Compact and requires enhanced due diligence for certain types of transactions, including those that involve palm oil, soy and timber products.

The Framework requires that clients demonstrate a commitment to the responsible practice framework that pertains to the relevant soft commodity (e.g. Forest Stewardship Council (FSC), Roundtable on Sustainable Palm Oil (RSPO), Roundtable on Responsible Soy (RTRS), etc.).

Commitment is defined, for example, as active membership of or adherence to the relevant framework or organization, a credible, time-bound plan for certification to the relevant standard and/or evidence (e.g., via public reporting) of progress toward certification.

Approach to transactions where adherence to our policies is not clearly determinable

In the context of more complex transactions, where the degree of adherence with a particular policy is not clearly determinable, the transaction would be subject to additional due diligence procedures. Where due diligence procedures cannot practicably resolve a potential policy issue within the required timeframe, we may pursue one of the following options:

- We may require the commissioning of an independent technical report to establish the data required to make a full determination regarding adherence, and if necessary, a remediation plan to address areas of concern. Such measures may be reflected in legal documentation relating to a transaction.

- The transaction may be subject to active monitoring to ensure that at the next available opportunity (typically a subsequent transaction with the client) an update is obtained on the outstanding areas of concern. Failure to address these issues within an acceptable timeframe may result in internal escalation.

- The transaction may be escalated to the relevant internal Reputation Risk Committee, which may result in the transaction being declined.

- Where client relationships are longstanding, the preferred approach is to proactively engage clients and highlight expectations that outstanding issues are addressed in advance of any transaction.

Reporting on our progress

We will report on our progress toward implementation of the commitments under the Soft Commodities Compact periodically via the company website. This report is based on data currently available, and we anticipate that as the various certification schemes mature, and member companies provide more detailed data in their own reporting, that the level of useful data available for banks to report will also improve over time.

Certification status statistics cited here are based solely on client-reported information in the public domain and on our review of public databases provided by the various certification schemes.5

Our Progress

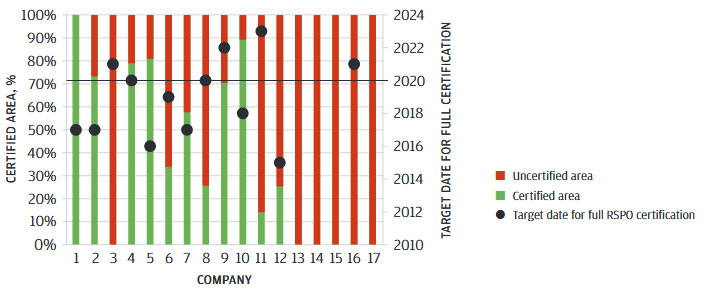

The following charts illustrate the certification status of relevant J.P. Morgan clients operating in the palm oil, timber products and soy sectors as of Q4 20176. All data is anonymized.

Note that for soy and timber, it is not possible to verify the extent to which certifications cover client operations and products, based on review of publicly-available information.

Companies may report certification to be in place, but do not provide sufficiently detailed data to allow a determination of (i) whether or not the certification(s) achieved cover all operations (or what percentage of operational units/product are certified), or (ii) the extent to which interests (either majority or minority) in other operating entities are included in the company’s own certification schemes.

In addition, not all clients publish details of any time-bound plans to achieve certification. Details regarding the extent of certification coverage and/or time-bound plans would typically be reviewed during dialogue with the client in the context of a transaction.

Palm Oil

RSPO certification status of clients in the palm oil sector

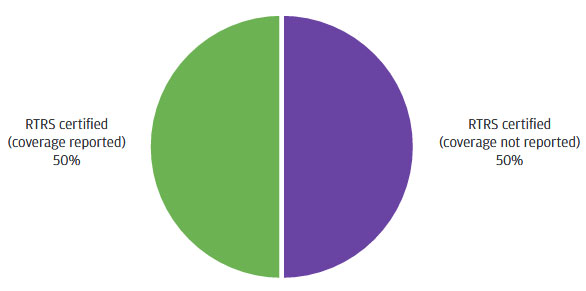

Soy

Percentage of clients with operations certified or covered by a time-bound plan to achieve RTRS certification

NOTES:

All clients (100%) report both membership of RTRS and securing of RTRS certifications. However, not all clients report the extent to which their operations are certified (i.e., certification ‘coverage’).

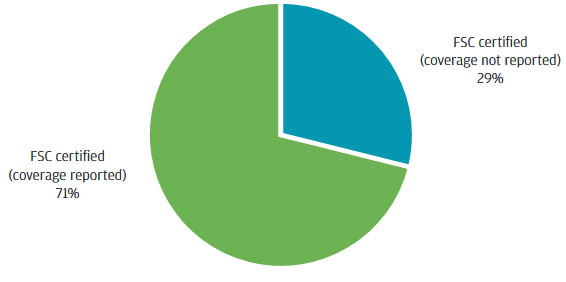

Timber Products

Percentage of clients with operations certified or covered by a time-bound plan to achieve FSC certification

NOTES:

All clients (100%) report both membership of FSC and securing of FSC certifications. However, not all clients report the extent to which their operations are certified (i.e., certification ‘coverage’).

Verification of adherence to our policies

J.P. Morgan will rely on the certification status as reported by clients in the public domain to determine the proportion of clients verified as adhering to our approach to implementing the Soft Commodities Compact commitments. Determinations of adherence will be complemented by customary due diligence and review procedures as outlined in the Firm’s Environmental and Social Policy Framework.

Notes:

All clients (100%) report both membership of RTRS and securing of RTRS certifications. However, not all clients report the extent to which their operations are certified (i.e., certification ‘coverage’).

All clients (100%) report both membership of FSC and securing of FSC certifications. However, not all clients report the extent to which their operations are certified (i.e., certification ‘coverage’).